KCRMD BALLOT ISSUE 6F DEFEATED

The election results for Ken-Caryl Ranch Metropolitan District Ballot Issue 6F are as follows:

34% For

66% Against

Ballot Issue 6F asked voters whether or not they wanted to retain 2/3 of the expiring bond repayment mill levy for a period of 10 years for the purpose of funding future capital infrastructure and maintenance of capital infrastructure.

Mill Levy Ballot Issue 6F on Nov. 5, 2024 Ballot

At the July 23, 2024 Ken-Caryl Ranch Metropolitan District Board meeting, the Board passed a resolution to place a mill levy ballot issue on the Nov. 5, 2024 ballot. The ballot issue will ask voters whether or not they want to retain 2/3 of the expiring bond repayment mill levy for a period of 10 years for the purpose of funding future capital infrastructure and maintenance of capital infrastructure. The County Clerk and Recorder has assigned Ballot Issue 6F for KCRMD’s Nov. 5, 2024 mill levy ballot measure.

Metropolitan District Mill Levy Information

Loading files...

2014: District’s voters approved the current bond mill levy, incurring debt in the form of General Obligation Bonds to be paid off in December 2024.

2015-17: Bond money used for Ranch House, Community Center, and Dakota Lodge renovations, new community entrance signs, playgrounds, and park improvements.

December 2024: Bond debt will be paid off and repayment mill levy will end. (Note: the District paid $1.2 million in interest)

More Information

Capital expenditures are made to maintain the quality and condition of the Ken-Caryl Ranch Metropolitan District’s assets. All property or equipment related to an infrastructure asset are considered capital projects.

The District’s long-term capital improvement plan, initially formulated during the 2022 budget process, is now updated annually. It encompasses projects projected through 2050 for District-owned or leased properties and equipment, along with some maintenance for several Master Association assets. Although the plan anticipates needs well into the future, the Board only approves the current year of projects as part of the annual budget adoption process.

The Capital Plan is based on four specific sources of information:

• Capital Asset Estimated Life Expectancy

• Community Survey Priorities

• 2023-2027 Strategic Plan

• Immediate Needs

Capital projects include maintenance items such as:

• HVAC Systems

• Flooring

• Lighting

• Tennis Court Resurfacing

• Roofing

• Irrigation Systems and Controls

• Parking Lot Maintenance

• Pool Boiler

• Pool Concrete Decking

• Painting

• Park Benches, Picnic Tables, and Signage

Capital projects also include new and replacement projects such as:

• Playgrounds (Community Center, Community Park, North Ranch Park)

• Community Park Master Plan first phase

• Community Center pool improvements

• Fitness equipment at the Community Center

• Parking expansion south of the playground and Community Garden at the Community Center

• Vehicles, mowers, equipment, snow removal machines, trailers, truck snow plows

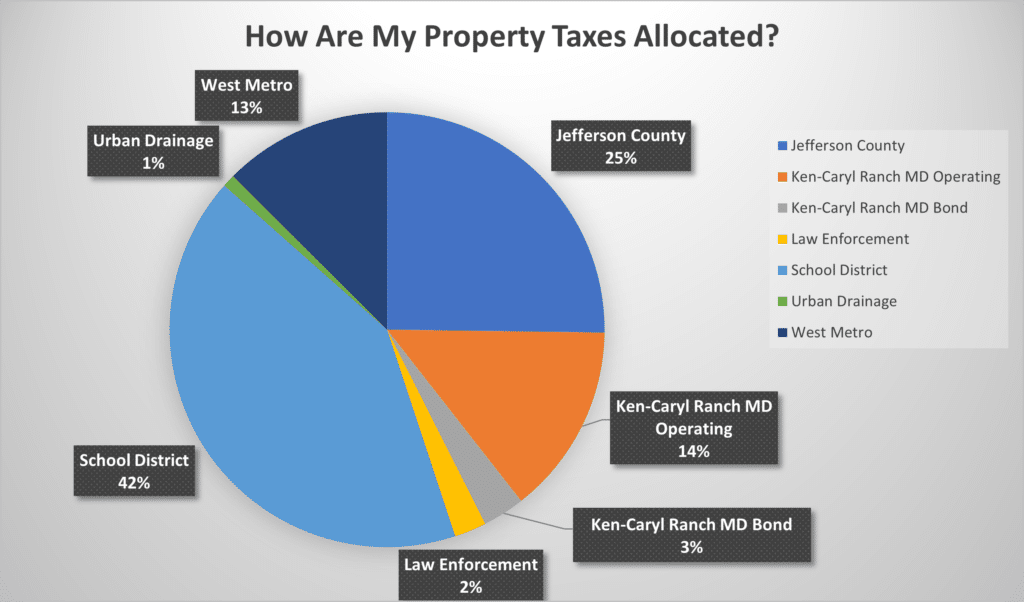

Property owners pay property taxes to the Jefferson County Treasurer’s Office each year. The Treasurer’s Office collects the taxes and then disburses funds to various taxing authorities such as the school district, special districts, Jefferson County and law enforcement.

Your property taxes are based on the property “assessed value” established by the Jefferson County Assessor and the total mill levies for the taxing authorities that provide public services. A mill is 1/10 of one cent, or $1 of revenue for each $1,000 of assessed value. A property’s “assessed value” is calculated by multiplying the property’s actual value, as determined by the Assessor, by a reduced rate set by the legislature to arrive at an assessed value. Currently, the reduced rate is 6.7%. The amount of tax due is then calculated by multiplying the assessed value by the tax mill levy for each taxing authority within the tax district.

Did you know that the largest portion, 42%, of your property tax bill goes to Jefferson County Public Schools? Your local park and recreation provider, the Ken-Caryl Ranch Metropolitan District, receives 14% of your total property tax bill for general operating expenses and another 3% for the bond repayment mill, totaling 17%. The bond repayment mill, which makes up 3% of your total property tax bill, began in 2014 and is set to expire in December 2024. See the pie chart with this article for a full breakout of your property tax allocations.